The unified API market has matured beyond simple connector aggregation. Today's platforms differentiate on architecture, pricing philosophy, and domain expertise. Unified.to positioned itself around three pillars: stateless request routing, broad category coverage, and consumption-based billing. These choices work well for certain integration patterns but create friction for others.

This evaluation examines Unified.to's technical approach, identifies where it excels, and maps alternative platforms to specific engineering requirements. The goal isn't to declare a winner but to help technical teams match platform capabilities to their actual needs.

Unified.to's Technical Foundation

Stateless Request Routing

Unified.to processes API requests without maintaining persistent data stores. Your request arrives, gets authenticated against the target system, executes, and returns. The platform acts as an intelligent proxy layer rather than a data warehouse.

This design eliminates sync lag entirely. Data returned from Unified.to reflects the source system's current state, not a snapshot from the last polling interval. For applications where stale data creates business problems such as financial reconciliation, inventory management, and real-time analytics, this architecture removes an entire class of data freshness bugs.

The trade-off manifests in latency. Each request must complete a full round-trip to the source API. Response times typically range from 800ms to 1.5 seconds depending on the target system's performance. Applications optimized around cached data access patterns may need architectural adjustments.

Category Coverage vs. Domain Depth

Unified.to spans 24 API categories with 378+ connectors: HR, recruiting, CRM, accounting, file storage, marketing, ticketing, messaging, and more. This breadth serves products that touch multiple data domains. A workflow automation platform might need calendar data, CRM records, and ticketing information within the same feature set.

Breadth comes at a cost. Engineering resources spread across maintaining hundreds of connectors rather than deepening individual integrations. For teams whose primary need concentrates in a single domain, particularly accounting for fintech applications, generalist platforms may lack the object coverage and edge case handling that specialized solutions provide.

Consider what "accounting integration" actually requires for a lending product: pulling trial balances, accessing journal entry details, reading aged receivables reports, syncing tax rate configurations, and handling multi-currency transactions. A platform optimizing for breadth may support basic invoice and bill operations while lacking these deeper objects.

Consumption-Based Economics

Unified.to's pricing ties directly to API call volume. The Grow tier provides 750,000 monthly requests for $750 with $1.00 per thousand overage. Scale offers 6 million requests for $3,000 with reduced overage rates. Both tiers include unlimited customer connections and access to all 24 API categories.

This model rewards efficiency. Teams that optimize request patterns and implement intelligent caching on their end pay less. It also creates cost predictability for steady-state workloads where API consumption stays consistent month-over-month. The unlimited connections aspect particularly benefits products with large customer bases but moderate per-customer API usage.

The challenge emerges with variable consumption patterns. Fintech products often see traffic spikes during month-end closes, tax seasons, or promotional periods. A 3x spike in API volume translates directly to billing increases. Infrastructure costs become harder to forecast when they correlate with customer activity rather than customer count.

Additionally, different integration categories consume API calls at vastly different rates. A simple CRM contact sync might require 10 calls; a comprehensive accounting reconciliation could require hundreds. Products that rely heavily on data-intensive integrations may find their API consumption growing faster than their customer base.

Scenarios Where Teams Evaluate Alternatives

Developer Experience Gaps

SDK reliability and authentication UX represent practical friction points that surface during implementation. Inconsistent behavior across language-specific SDKs, error handling gaps, or unexpected edge cases require workarounds that extend development timelines. The efficiency gains from unified endpoints erode when teams spend cycles debugging client library issues.

Authentication components matter equally. Integration platforms depend on smooth end-user connection flows, and if the auth experience feels clunky or generates support tickets, the integration layer becomes a liability. Teams building customer-facing products need auth components that feel native to their application, not bolted on. When these foundational elements underperform, breadth advantages lose weight against platforms offering more polished developer tooling.

Accounting Integration Complexity

Fintech products such as lending platforms, spend management tools, AP automation, and tax compliance software require accounting integrations that go beyond basic CRUD operations. These applications need access to specialized objects, support for complex multi-entity configurations, and handling for accounting-specific workflows like period closes and journal reversals.

When evaluating accounting coverage, connector count misleads. The relevant questions: Does the platform expose chart of accounts hierarchies? Can you access tracking categories and cost centers? Does the write API support journal entries with proper debit/credit validation? How does authentication work for enterprise systems like NetSuite that use token-based auth with complex permission models?

Teams building accounting-centric products often find that generalist platforms handle 80% of requirements well but struggle with the remaining 20% that enterprise customers actually need.

Cost Modeling Challenges

Usage-based pricing creates tension with product economics when integrations are core features rather than premium add-ons. If every customer uses integrations heavily, per-call pricing can dominate infrastructure costs in ways that per-customer models don't.

Consider a SaaS product with 200 customers, each syncing accounting data hourly. At 24 syncs daily, with each sync requiring 50 API calls across objects, monthly consumption reaches 7.2 million calls. That exceeds Unified.to's Scale tier allocation, adding overage charges that vary with customer activity.

Platforms with per-customer or tiered pricing models provide more predictable unit economics. You know integration costs per customer regardless of how frequently they sync or how much data they process.

Enterprise Readiness and Scale Validation

When evaluating any integration platform, the vendor's stability and production track record matter as much as technical specifications. Teams need confidence that their integration layer will perform reliably as transaction volumes grow and that the vendor will continue investing in the platform long-term.

Look for platforms with established enterprise customers that process significant volumes, especially companies whose integration requirements mirror your own growth trajectory. A vendor supporting thousands of businesses with millions of monthly API calls demonstrates infrastructure maturity that newer entrants haven't yet proven. Financial backing, team tenure, and consistent product development signal a platform you can build on without worrying about migration risk in two years.

This validation becomes especially important for accounting integrations, where data accuracy directly impacts financial reporting. Production-tested platforms have encountered and solved edge cases around currency handling, multi-entity configurations, and rate limiting across major ERPs that less mature solutions may still be discovering.

Alternative Platforms by Use Case

Apideck — Accounting-Centric Architecture

Primary fit: B2B SaaS, vertical SaaS, and fintech teams where accounting and ERP integrations drive core product value.

Technical Approach

Apideck combines stateless request routing with deep investment in accounting domain coverage. The platform connects to 20+ accounting systems, including QuickBooks, Xero, NetSuite, Sage Intacct, Microsoft Dynamics, FreshBooks, MYOB, Exact Online, and others, with full create, read, update, and delete support across accounting objects.

The object model goes beyond invoices and bills. Apideck exposes journal entries, ledger accounts, tax rates, tracking categories, payment terms, and vendor records. For enterprise accounting systems, the platform handles multi-subsidiary configurations and custom field synchronization through dedicated field mapping capabilities.

Like Unified.to, Apideck routes requests directly to source systems without intermediate storage. Data freshness guarantees match what you'd get hitting the accounting API directly, and customer financial data never persists in Apideck infrastructure.

This passthrough architecture delivers meaningful security advantages. Apideck maintains SOC 2 Type II certification and GDPR compliance, but the compliance story goes deeper than certifications. Because customer data flows through without storage, Apideck never becomes a data processor holding your customers' sensitive financial information. Your audit scope stays simpler. Data subject access requests under GDPR don't extend to a vendor database that doesn't exist. The attack surface shrinks when there's no persistent data store to breach.

Where It Differs

The critical distinction is domain depth combined with pricing structure. While Unified.to spreads across 24 categories, Apideck concentrates engineering resources on making accounting integrations production-ready for demanding fintech use cases.

Pricing follows a hybrid model that adapts to different business patterns. The default consumer-based structure charges $599/month for 25 consumers at the Launch tier, $1,299/month for 100 consumers at Scale, where a "consumer" represents your customer connecting their accounting system. This decouples costs from API call volume, making unit economics predictable regardless of sync frequency. Teams whose usage patterns favor call-based billing can switch to an API-call-based plan instead. The flexibility to choose between models means you're not forced into a pricing structure that penalizes your specific integration patterns.

Technical Considerations

Latency characteristics mirror other passthrough architectures. Expect 800ms to 1.2 second response times depending on the target accounting system. NetSuite tends toward the slower end; cloud-native systems like Xero respond faster.

The platform includes escape hatches for edge cases. Proxy APIs let you access endpoints not yet covered by unified models. Field mapping handles custom fields that enterprise customers inevitably configure in their accounting systems.

Evaluation Criteria

Choose Apideck when accounting integrations are table stakes for your product, when you need deep object coverage beyond basic invoices and bills, when predictable per-customer pricing aligns better with your business model than usage-based billing, and when your roadmap may expand into adjacent categories like CRM, HRIS, or file storage within a single vendor relationship.

The platform's multi-category coverage spans 200+ integrations across accounting, CRM, HRIS, file storage, ecommerce, ATS, and issue tracking, which means teams can start with accounting depth and expand without switching vendors. This consolidation reduces operational complexity compared to managing separate integration providers for each data domain.

Merge — HR and Recruiting Specialization

Primary fit: Products where employee data, organizational hierarchies, and recruiting workflows represent core integration requirements.

Technical Approach

Merge built its platform around HR and recruiting use cases before expanding to other categories. The depth shows in HRIS and ATS coverage: 220+ integrations spanning major platforms like Workday, BambooHR, Greenhouse, Lever, and dozens of regional and industry-specific systems.

Architecturally, Merge uses periodic synchronization rather than stateless routing. The platform pulls data from source systems on configurable schedules, stores normalized records in Merge infrastructure, and serves queries from this cached layer. Response times drop significantly, typically to under 300ms, because queries hit Merge's database rather than traversing to source systems.

Where It Differs

The sync-based architecture inverts the data freshness trade-off. Queries execute faster, and source system outages don't immediately impact your application. However, data reflects the last successful sync rather than current state. For workflows where users expect to see changes immediately after making them in source systems, this delay creates UX friction.

Write operations execute asynchronously. Your POST request returns a 200 confirming the write entered Merge's queue, not that it completed in the source system. Applications need polling or webhook infrastructure to track write completion and handle failures.

Pricing uses per-linked-account billing: $650/month base fee plus $65 per connected account. At 100 customer connections, monthly costs reach approximately $7,150. Costs scale linearly with customer count regardless of how heavily each customer uses integrations.

Technical Considerations

Sync frequency varies by plan and integration. Some connections refresh hourly; others may take longer. For products where data freshness matters, verify sync intervals for your specific target systems before committing.

Feature access gates exist across pricing tiers. Full write capabilities, custom sync frequencies, and scopes management require Professional or Enterprise plans. Evaluate whether your requirements fit within Launch tier capabilities or necessitate higher tiers.

Evaluation Criteria

Choose Merge when HRIS and ATS integrations are primary requirements, when your application can tolerate sync-based data freshness, when sub-second query latency matters more than real-time data accuracy, and when per-account pricing aligns with your customer base and growth projections.

Codat — Lending-Specific Capabilities

Primary fit: SMB lending products where pre-built financial analysis features accelerate development.

Technical Approach

Codat specializes in financial data aggregation for lending use cases. Beyond basic accounting connectivity, the platform provides derived financial metrics: liquidity ratios, profitability calculations, cash flow summaries, and creditworthiness indicators computed from raw accounting data.

For underwriting applications, these pre-built analytics reduce implementation time. Instead of writing code to calculate current ratios from balance sheet data or debt service coverage from income statements, you consume Codat's assess endpoints that return standardized financial metrics.

Where It Differs

The lending focus shapes both capabilities and limitations. Codat excels at read-heavy workflows where you're pulling financial data for analysis. Write operations receive less emphasis. If your product needs to push data back into accounting systems, such as posting payments, creating invoices, or syncing transactions, verify that Codat's write coverage meets your requirements.

Category scope stays narrow: accounting, banking, and commerce. Products needing CRM, HRIS, or file storage integrations require additional vendors.

Architecture uses periodic synchronization. Data freshness depends on sync schedules, and queries return cached rather than real-time data.

Pricing follows sales-led models. Published rates aren't available; budget planning requires sales conversations.

Technical Considerations

Evaluate whether Codat's pre-built financial metrics actually match your underwriting models. If your credit decisioning uses standard ratios and metrics, Codat's assess features save development time. If your models require proprietary calculations or non-standard financial indicators, you'll compute those yourself regardless of platform choice.

Evaluation Criteria

Choose Codat when SMB lending is your core use case, when pre-built financial ratio calculations provide direct value, when your requirements stay within accounting, banking, and commerce domains, and when sales-led pricing processes fit your procurement workflow.

Nango — Infrastructure Control

Primary fit: Engineering teams requiring self-hosted deployment or deep customization beyond what managed platforms support.

Technical Approach

Nango provides integration infrastructure as deployable components rather than managed services. The platform handles OAuth flows, credential storage, token refresh, rate limit management, and request proxying. You deploy these components in your own cloud environment and maintain operational responsibility.

The open-source foundation allows inspection and modification. If Nango's default behavior doesn't match your requirements, you can adjust it. This flexibility extends to adding support for APIs not in Nango's catalog or modifying how existing integrations behave.

Where It Differs

Self-hosting transfers operational burden to your team. You manage deployment, monitoring, scaling, and incident response. The trade-off is complete infrastructure control, since data never leaves your environment and you are not constrained by vendor capabilities or roadmap priorities.

Nango doesn't provide unified data models in the same way as Apideck or Merge. The platform handles authentication and request mechanics; data normalization across different source APIs remains your responsibility. This requires additional development work but provides complete control over how data gets transformed and stored.

Technical Considerations

Evaluate your team's operational capacity honestly. Self-hosted infrastructure requires ongoing DevOps investment. Security patches, version upgrades, scaling events, and incident response all fall on your organization.

Cloud-hosted options exist for teams that want Nango's flexibility without self-hosting burden. Pricing starts at $50/month for starter tiers with usage-based scaling.

Evaluation Criteria

Choose Nango when compliance requirements mandate self-hosted infrastructure, when you have DevOps resources for ongoing operations, when managed platforms can't accommodate your customization requirements, and when you're willing to trade convenience for control.

Plaid — Banking Data Access

Primary fit: Products requiring direct bank account connectivity alongside accounting or commerce integrations.

Technical Approach

Plaid connects to financial institutions for account verification, transaction history, balance information, and payment initiation. Coverage spans 12,000+ banks and credit unions through a consumer-focused authentication flow optimized for end-user account linking.

Where It Differs

Plaid serves a fundamentally different data layer than unified API platforms. It accesses bank accounts directly rather than accounting software. A business might use QuickBooks for bookkeeping while banking with Chase, and those are separate systems that require separate integrations.

This makes Plaid complementary rather than competitive. Products needing both accounting data and banking data typically use Apideck or similar for accounting alongside Plaid for bank connectivity.

Technical Considerations

Authentication flows optimize for consumer experience. The UI assumes end-users are linking personal or business bank accounts. B2B integration patterns where businesses connect accounting systems feel different from Plaid's bank-linking experience.

Evaluation Criteria

Use Plaid when your product requires direct bank account access for verification, transaction analysis, or payment initiation. Pair it with an accounting-focused unified API for complete financial data coverage.

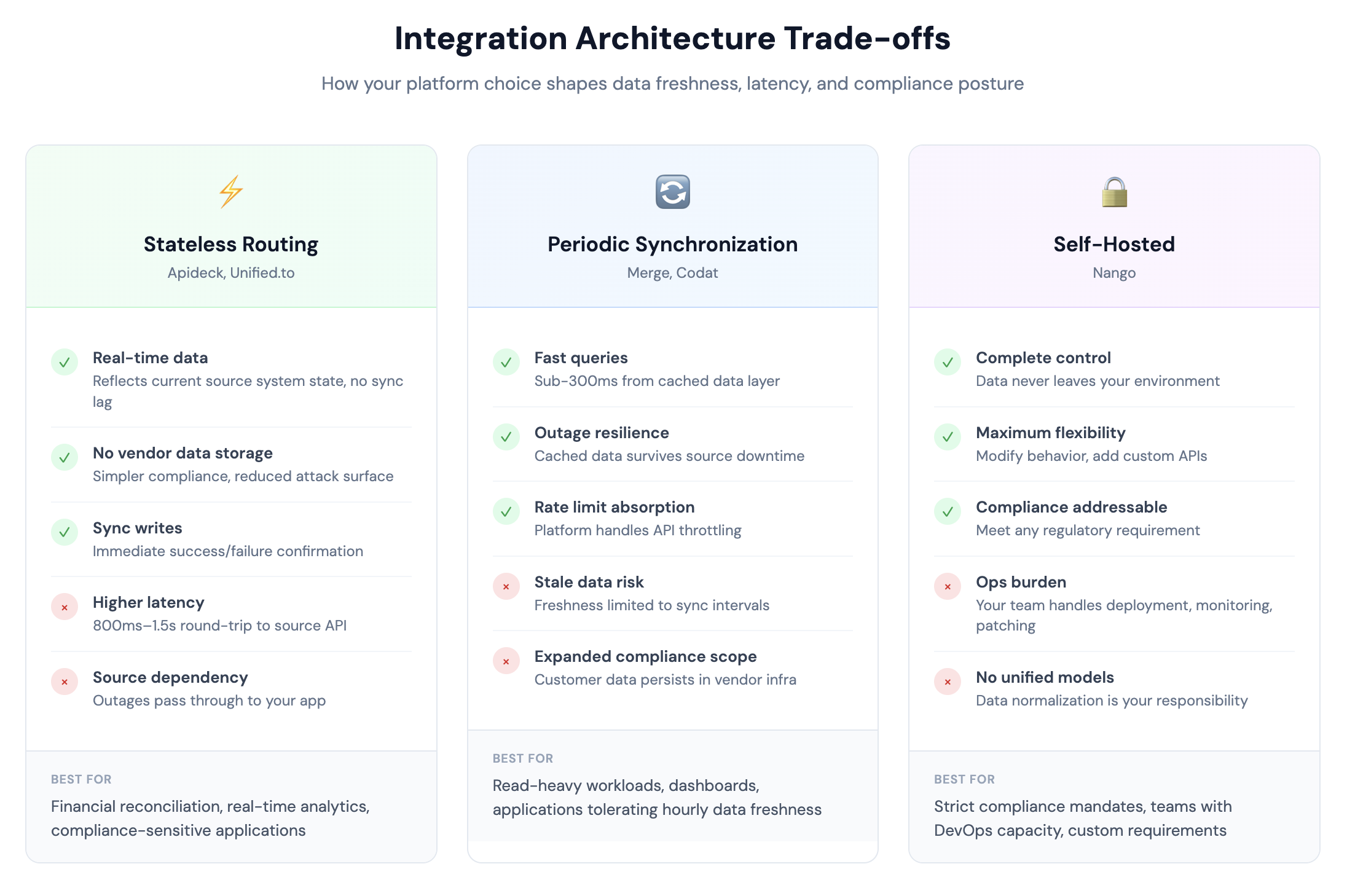

Architectural Trade-offs Summary

The fundamental architecture choice shapes everything from data freshness to compliance posture. Understanding these trade-offs helps match platform capabilities to your specific requirements.

Stateless Routing (Apideck, Unified.to)

- Data reflects current source system state

- Latency includes full round-trip to source API (typically 800ms-1.5s)

- No vendor data persistence simplifies compliance

- Source system outages impact your application directly

- Write operations complete synchronously, so you know immediately whether they succeeded

- Rate limits from source APIs pass through to your application

Periodic Synchronization (Merge, Codat)

- Faster query response from cached data (typically under 300ms)

- Data freshness limited by sync frequency (hourly to daily depending on plan)

- Customer data persists in vendor infrastructure, which adds to your compliance scope

- Resilience against source system outages via cached data

- Write operations queue asynchronously, which requires polling or webhooks to confirm completion

- Platform absorbs some rate limiting complexity

Self-Hosted (Nango)

- You get complete infrastructure control, and data never leaves your environment

- Operational responsibility transfers to your team (deployment, monitoring, patching)

- Maximum flexibility for customization and API additions

- There are no unified data models, so normalization is your responsibility

- Compliance requirements fully addressable through infrastructure choices

- Requires DevOps investment proportional to integration complexity

Pricing Model Comparison

| Platform | Model | Entry Point | At Scale |

|---|---|---|---|

| Apideck | Per-consumer or API-call based | $599/mo (25 consumers) | $1,299/mo (100 consumers) |

| Unified.to | Usage-based (API calls) | $750/mo (750K calls) | $3,000/mo (6M calls) |

| Merge | Per-linked-account | $650/mo base + $65/account | ~$7,150/mo (100 accounts) |

| Codat | Sales-led | Contact sales | Contact sales |

| Nango | Usage-based (cloud) or self-hosted | $50/mo (cloud) | Variable |

| Plaid | Per-connection + usage | Contact sales | Contact sales |

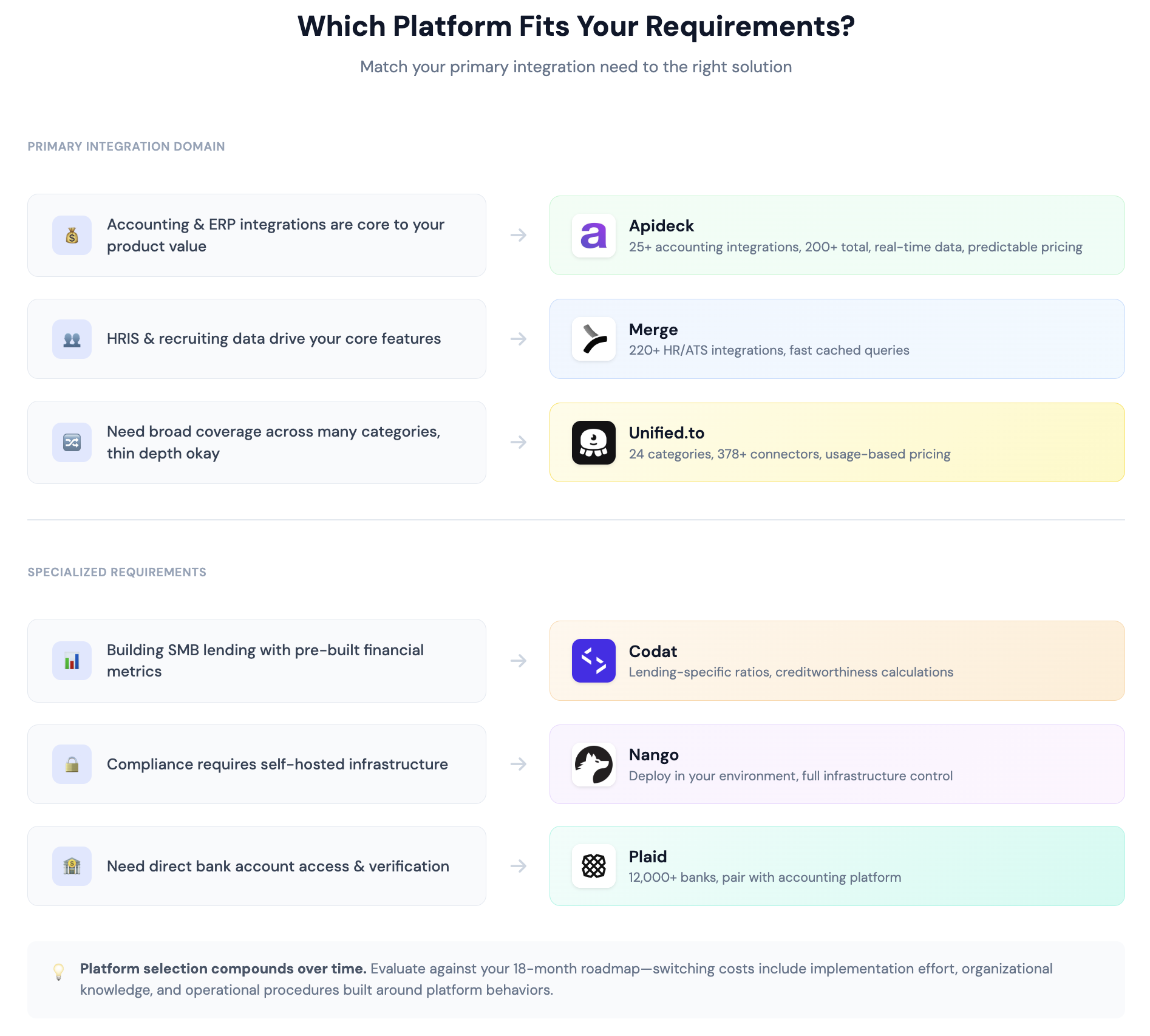

Selection Framework

- Accounting depth matters most: Evaluate Apideck. The platform combines stateless routing with concentrated investment in accounting object coverage and predictable per-consumer pricing.

- HR and recruiting drive requirements: Evaluate Merge. Deep HRIS and ATS coverage with sync-based architecture suits products where those domains are central.

- Broad category with thin unification: Evaluate Unified.to. Twenty-four API categories through a single vendor, with usage-based pricing that rewards efficient request patterns.

- Lending-specific features valuable: Evaluate Codat. Pre-built financial metrics accelerate underwriting workflows if they match your models.

- Infrastructure control required: Evaluate Nango. Self-hosting options for teams with compliance constraints or customization needs that managed platforms can't accommodate.

- Bank account access needed: Add Plaid alongside your accounting integration platform for direct financial institution connectivity.

Final Considerations

Platform selection compounds over time. Switching costs include not just implementation effort but also the organizational knowledge embedded in integration code, the support relationships built with vendor teams, and the operational procedures developed around specific platform behaviors.

Evaluate platforms against your 18-month roadmap, not just current requirements. If accounting integrations are table stakes today and your product will expand to require deeper financial workflows, starting with an accounting-specialized platform avoids future migration. If breadth across categories matters more than depth in any single domain, a generalist platform may serve better.

Consider the hidden costs beyond monthly fees. Integration failures require debugging time. Missing object coverage forces workaround development. Inadequate documentation slows onboarding. These factors rarely appear in feature matrices but significantly impact total cost of ownership.

Security and compliance requirements deserve early attention. Passthrough architectures that avoid data storage simplify your compliance posture but may not satisfy all regulatory requirements. Sync-based platforms that cache data create additional audit scope. Self-hosted solutions provide maximum control but transfer operational responsibility entirely to your team.

For B2B SaaS, vertical SaaS, and fintech teams where accounting integrations underpin core product value, Apideck's combination of domain depth, stateless architecture, and predictable pricing provides the strongest technical foundation. The platform handles the accounting complexity that enterprise customers demand while leaving room to expand into adjacent categories as product requirements evolve. The passthrough architecture, backed by SOC 2 Type II certification and GDPR compliance, ensures sensitive financial data never persists in vendor infrastructure, which keeps your compliance posture clean and your attack surface minimal.

The integration layer sits at the foundation of your product's data architecture. Choose infrastructure that matches where your product is heading, not just where it stands today. The right platform accelerates development, simplifies compliance, and scales predictably with your business. The wrong one creates technical debt that compounds with every new customer and feature.

Ready to get started?

Scale your integration strategy and deliver the integrations your customers need in record time.